Renters Insurance in and around Colorado Springs

Welcome, home & apartment renters of Colorado Springs!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

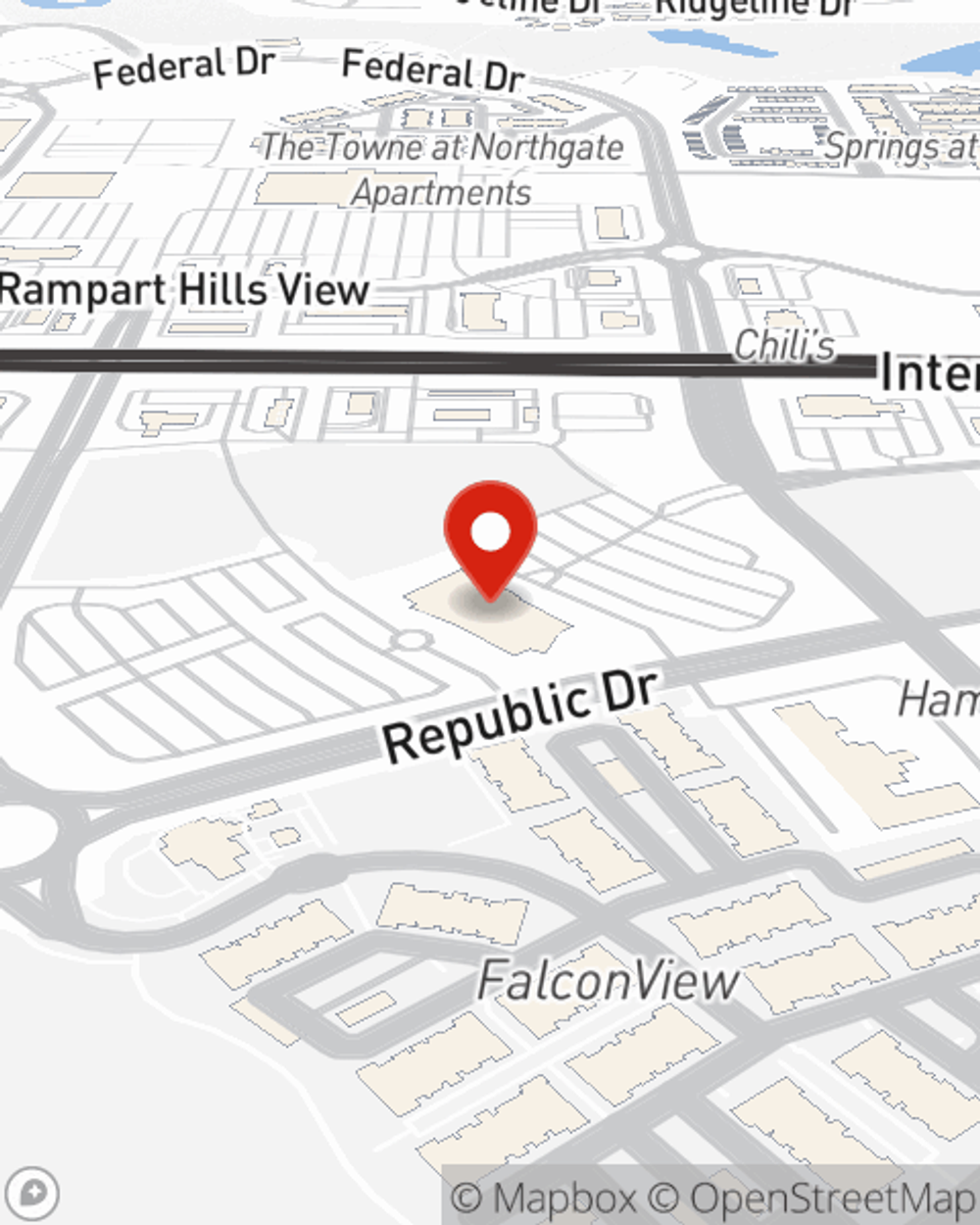

- Interquest Parkway

- Colorado

- Denver, CO

- Front Range

- Rocky Mountains

- Fountain, CO

Protecting What You Own In Your Rental Home

It may feel like a lot to think through your sand volleyball league, your busy schedule, keeping up with friends, as well as deductibles and coverage options for renters insurance. State Farm offers straightforward assistance and impressive coverage for your appliances, home gadgets and sound equipment in your rented condo. When trouble knocks on your door, State Farm can help.

Welcome, home & apartment renters of Colorado Springs!

Renting a home? Insure what you own.

Why Renters In Colorado Springs Choose State Farm

You may be wondering: Can renters insurance help protect you? Just pause to consider the cost of replacing your possessions, or even just a few of your high-value items. With a State Farm renters policy in your pocket, you won't be slowed down by thefts or accidents. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Sarah Wright can help you add identity theft coverage with monitoring alerts and providing support.

As a trustworthy provider of renters insurance in Colorado Springs, CO, State Farm is committed to keeping your life on track. Call State Farm agent Sarah Wright today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Sarah at (719) 785-3728 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Sarah Wright

State Farm® Insurance AgentOffice Address:

Suite 440

Colorado Springs, CO 80921-3777

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.